All Categories

Featured

Table of Contents

[/video]

And what happened is, is that I shed a high-frequency hearing in my appropriate ear, and I might refrain that job properly since I was the, type of the behind the scenes man that blended the records. So I combined thousands of documents, which was primarily what I did.

Which is very, really comparable to painting. And it's kind of like a painter that all of an unexpected beginnings to lose his color perception? If you can not listen to properly, you can't mix. That is why I finished up going, wow, this is a massive effect for me having this earnings defense - what is infinite banking.

That's what I did. Which was kind of the germination of realizing just how vital earnings protection is. And by the way, that has nothing to do with unlimited financial. Okay. Infinite banking has no part of what I'm discussing in it. So I produced a method called Bulletproof Riches that checks out everything a little extra holistically.

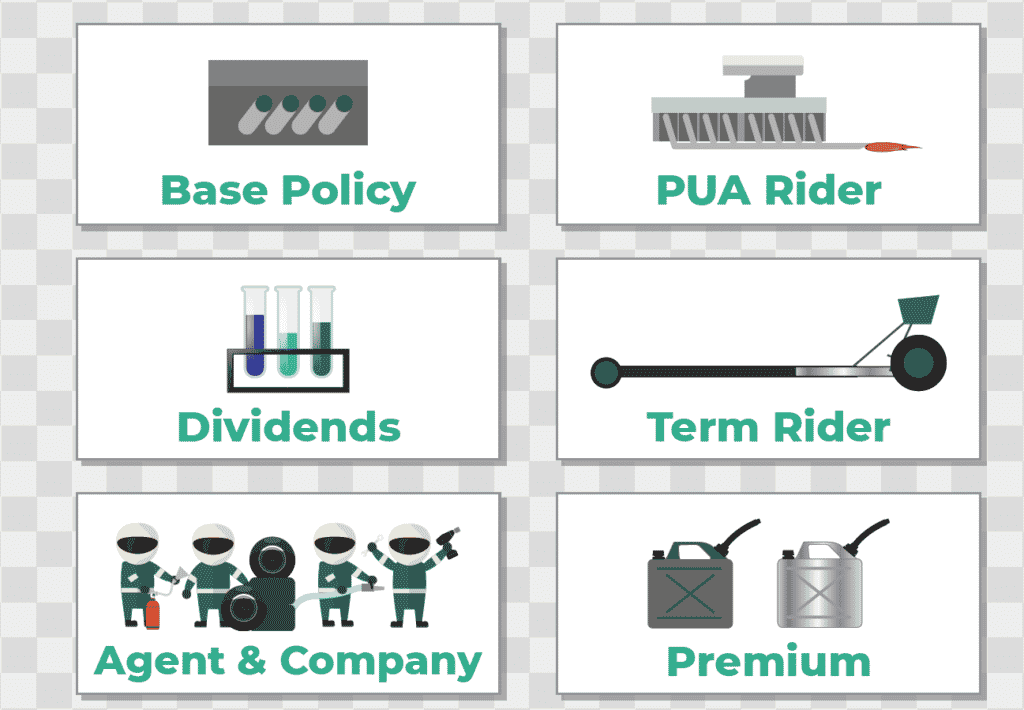

Leading is a long-term specially made long-term special needs policy with these one-of-a-kind riders that most individuals don't obtain. Okay. And that shields your ability to make money. That is the leading thing we have to protect your earnings. Phone number 2 is a financial plan, alright, however it's not a directly, Hey, this is a boundless banking plan.

And I achieved that through what they call disability waiver premium authors, which is a little bit complex, but what it indicates is that the whole point is not going to blow up. If for some reason you obtain ill or harming, can't function.

And the third aspect, the last and third component to the Bulletproof wealth strategy is an alternative method that uses exchangeable term insurance coverage. To offer you the ability to a secure your household, to the maximum possible revenue substitute that you can do. And after that B enable you to get a larger banking policy as you earn even more cash in the future without having to re qualify medically.

Infinite Banking Concept Example

Sure, certain Marco. Term term insurance coverage is where you place in the least amount of cash possible for the most amount of life insurance policy. That's what term insurance is. Now, if you gain $200,000 a year and you are, allow's state a 45 year old man, you can certify for 25 times your revenue or five, $5 million.

So you can get several on your earnings. And a lot of times people do not place, you know, don't have the resources to do that all with a big banking policy. So I make certain that they can have this term insurance coverage, which is extremely inexpensive, however it offers them the capability to get an entire life plan or a financial plan in the future.

Infinite Banking Strategy: Build Your Personal Bank

Yeah. So establishing a bundle like this gives you as numerous choices as feasible, and it permits you to action in and not go done in at once. At the very start, it permits you to step in, however only have to qualify when. That is what is so appealing regarding the method that I establish this up is that you're not claiming, you understand, allow me just go a hundred miles an hour? To start, you can phase in to saving a lot more and extra of your revenue.

And at the very start of it, you're completely covered, right? As soon as we, once we obtain you onboarded, you're totally covered to one of the most, you can be safeguarded. There's this financial policy that offers you the capability to conserve money. There. That's, that is the middle part of the technique.

And that shields your ability to earn a living? And then there is exchangeable term insurance policy. The third thing that allows you to create a larger banking plan in the future, whenever you are prepared, those are the 3 elements.

Bank On Yourself Life Insurance

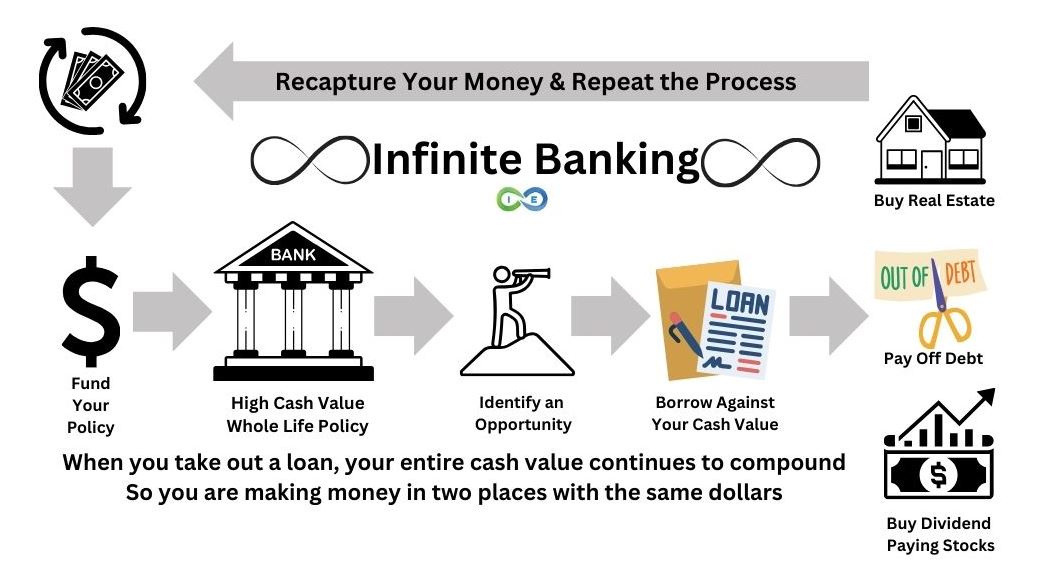

So when an offer emerges, that you really like the terms and it looks like a great possibility. You can jump on it and make use of it. The entire thing is, is the problem with that is that commonly real estate investors, to be able to leap on a bargain when it comes along, conserve their cash in a checkings and cost savings account, they just essentially leave it in a financial institution so that it's fluid and ready to leap on a, an opportunity.

Let's say you have a hundred thousand dollars in a financial institution, and after that you find it an investment, a syndication or something that you're desiring to put a hundred thousand into. Currently it's gone from the bank and it's in the submission. It's either in the bank or the syndication, one of the 2, but it's not in both.

And I try to assist people recognize, you recognize, just how to boost that effectiveness of their, their money so that they can do more with it. And I'm truly going to try to make this simple of using an asset to acquire another asset.

And then you would take an equity placement versus that and utilize it to acquire one more property. You recognize, that that's not an a foreign concept at all, correct?

And after that using that realty to acquire even more real estate is that after that you end up being extremely exposed to property, meaning that it's all associated. Every one of those assets become associated. So in a decline, in the whole of the realty market, then when those, you understand, things start to lose value, which does occur.

It hasn't taken place in a while, but I don't understand. I bear in mind 2008 and 9 pretty well. Uh, you understand, therefore you don't want to have every one of your possessions associated. So what this does is it provides you an area to place money originally that is completely uncorrelated to the real estate market that is going to be there assured and be ensured to increase in worth in time that you can still have a really high collateralization variable or like a hundred percent collateralization of the cash money worth inside of these policies.

Infinite Bank Concept

I'm attempting to make that as straightforward as feasible. Does that make feeling to you Marco?

So if they had a house worth a million bucks, that they had actually $500,000 paid off on, they could most likely obtain a $300,000 home equity line of credit score since they commonly would obtain an 80 20 finance to worth on that. And they could obtain a $300,000 home equity line of credit rating.

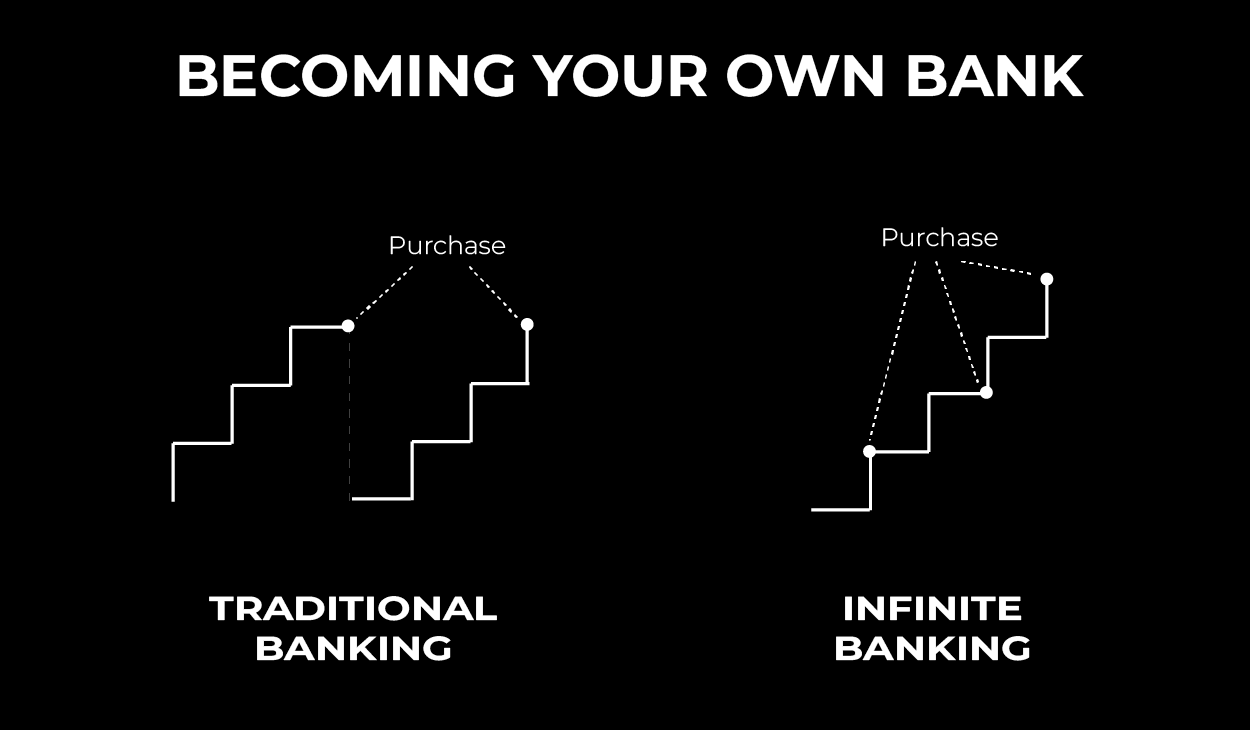

For one point, that credit history line is taken care of. In various other words, it's going to continue to be at $300,000, no matter how long it goes, it's going to stay at 300,000, unless you go get a new appraisal and you obtain requalified financially, and you increase your credit score line, which is a large pain to do every time you place in money, which is usually when a year, you contribute brand-new funding to one of these specifically developed bulletproof riches policies that I develop for people, your internal line of credit or your access to funding goes up every year.

Allow's say you have a hundred thousand dollars in a financial institution, and afterwards you find it an investment, a submission or something that you're intending to put a hundred thousand right into. Now it's gone from the bank and it remains in the syndication. It's either in the financial institution or the submission, one of the two, but it's not in both.

It actually is. And I try to aid individuals recognize, you recognize, exactly how to raise that effectiveness of their, their money to ensure that they can do even more with it. There's this concept. And I'm actually going to attempt to make this simple of using a property to acquire one more possession.

And after that you would certainly take an equity position versus that and use it to get another home. You recognize, that that's not an an international concept at all, correct?

Whole Life Insurance For Infinite Banking

And after that utilizing that real estate to buy more property is that after that you come to be very subjected to genuine estate, implying that it's all correlated. Every one of those assets come to be associated. In a slump, in the entirety of the genuine estate market, after that when those, you know, points begin to lose value, which does happen.

It hasn't taken place in a while, however I do not understand. I remember 2008 and nine pretty well. Uh, you know, therefore you do not want to have all of your possessions associated. So what this does is it gives you a place to put money at first that is totally uncorrelated to the property market that is going to be there ensured and be ensured to raise in value with time that you can still have a very high collateralization aspect or like a hundred percent collateralization of the cash value inside of these plans.

I'm attempting to make that as basic as feasible. Does that make feeling to you Marco? Yes, exactly. Exactly. That is, that is precisely the essential point is that you're growing an asset that is ensured to expand, yet you have the ability to obtain versus it, to take into an additional possession.

If they had a house worth a million bucks, that they had $500,000 paid off on, they might possibly obtain a $300,000 home equity line of credit scores since they generally would obtain an 80 20 loan to worth on that. And they might get a $300,000 home equity line of credit history.

Okay. There's a great deal of issues with doing that however, that this addresses with my approach fixes. For one point, that credit report line is repaired. Simply put, it's going to stay at $300,000, despite the length of time it goes, it's mosting likely to remain at 300,000, unless you go obtain a new evaluation and you get requalified financially, and you increase your credit rating line, which is a huge discomfort to do every time you place in cash, which is normally when a year, you add brand-new capital to among these specifically created bulletproof wealth plans that I create for individuals, your internal line of debt or your accessibility to funding goes up each year.

Latest Posts

Whole Life Insurance Cash Flow

Bank On Yourself Whole Life Insurance

Life Insurance Banking